Q2 2025 Retail Report

Q2 2025 Retail Market Report

The Toronto retail real estate market shows signs of strength and strain in the second quarter of 2025. Over the past decade, population growth outpaced retail development, rising 9% since 2016 while retail inventory expanded by only 3.6%. That gap has left the region with limited space availability and constrained new construction.

GTA Retail Sales

Vacancy and availability rates held near historic lows at 1.5% and 1.6% respectively. Despite positive net absorption over the past year, limited new supply has been restrictive. Just 1.8 million square feet are under construction across the entire GTA, representing only 0.6% of total inventory.

Rental rates appear to have hit a ceiling, with the average asking rent sitting at $35.38 per square foot. Rates vary widely depending on location, from a high of $67 in North Toronto to lows around $25 in the eastern submarkets. Year-over-year rent growth is flat, and with economic headwinds gaining momentum, downward pressure may increase in the coming quarters.

GTA Retail Market Data

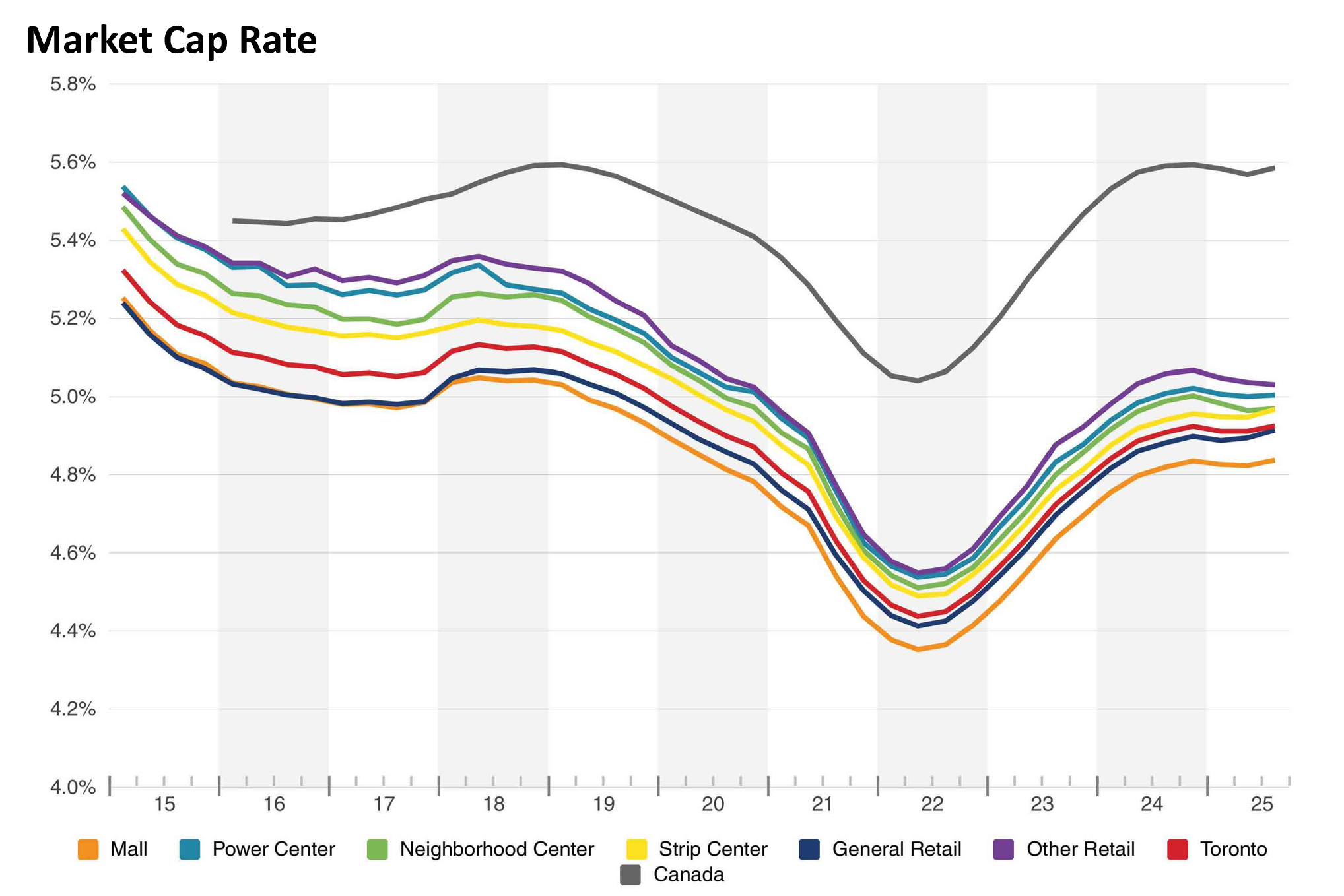

Retail cap rates across the GTA continue to compress, particularly in Toronto, where they remain below the national average—most notably for malls and power centres. This trend reflects strong investor confidence and sustained demand for well-located retail assets. Lower cap rates mean higher valuations and tighter competition, but they also signal income stability in a market that’s proven resilient.

Bond yields are playing a bigger role in how these assets are priced. Retail real estate moves in direct response to shifts in the bond market—when yields adjust, so do valuations. With the 5-year bond expected to hover around 3% through Q3 2025, and the Big Six banks projecting a possible drop to 2.6%, there’s potential for upward pressure on asset values heading into year-end. That said, inflation and global risk could push rates higher, so timing and positioning remain critical.

GTA Demographics

On the fundamentals side, Toronto continues to outperform. Job growth topped 5% year-over-year, well ahead of the national pace.

Population growth hit 3.4% in 2024, fueled by immigration and a rise in non-permanent residents. These factors are supporting steady retail demand across the region.

At the same time, affordability pressures are driving some residents out of the city, particularly through intra- and interprovincial migration. For retail investors and tenants, the key is to focus on high-growth pockets—areas where job gains and new arrivals are concentrated. That’s where retail traffic, leasing activity, and long-term value will hold strongest.

Outlook

The outlook for GTA retail remains cautious. While fundamentals remain strong, market momentum is softening. Slower population growth and economic headwinds could reduce future retail demand. Still, Canadian retailers with local supply chains may gain an edge as global trade frictions and online retail recalibrate consumer behavior.

For further reading: