Q3 2025 Residential Land Report

Residential Land Market

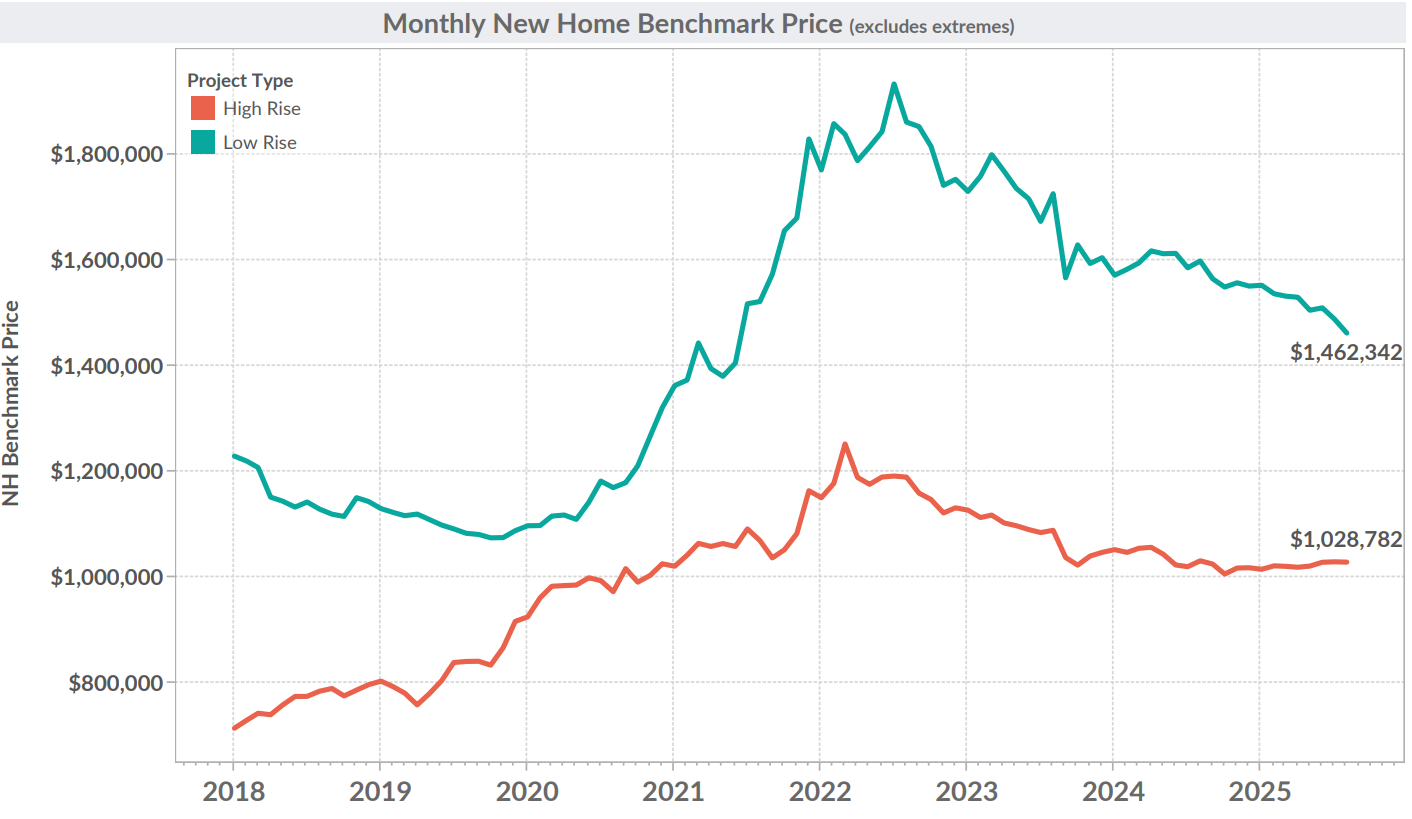

The Q3 2025 Residential Housing market reflected cautious optimism amid ongoing adjustments to price and borrowing costs. Transaction volumes were steady compared to the previous quarter, with builders and buyers finding a new equilibrium. While overall sales remain well below the highs of 2021–2022, stability is returning to re-sale pricing, and several key indicators point to a market regaining its footing after two years of volatility impacting the pre-construction market.

There was only 1 notable low-rise land transaction in the entire GTA during Q3, making it one of the worst quarters historically for this segment. This lack of activity underscores serious builder hesitation, as most are waiting for a decisive price floor to emerge. Builders are also being hampered by a lack of cash flow due to lack of new home sales and the lack of available land financing.

Builders remain cautious; awaiting further anticipated HST cuts/adjustments in the upcoming federal budget (expected November 4, 2025). The uncertainty over economic policy and potential reductions in development charges is contributing to a “wait-and-see” approach, driving both fewer new launches and new land purchases.

Only a single successful low-rise launch in Vaughan was observed, further highlighting consumer economic sensitivity.

Even with a recent interest rate cut—which technically improves affordability, the consumers' confidence and job security concerns remain a drag. This hesitation is a weight on Buyer activity, despite improved cost metrics.

The low-rise resale market continued its downward momentum to the end of Q3. Sales volume remains consistent, though heavily influenced by affordability constraints and cautious consumer sentiment.

In contrast, high-density (condominium) land in core Toronto remained relatively active. The market has seen a noticeable “flight to quality,” with buyers and institutional investors preferring prime, centrally-located sites over peripheral or less proven locations.

Apartment completions scheduled for 2025 remain high, signaling a continued further inventory pressure and a need to address rental/ownership demand. The volume of pre-construction apartment sales has stabilized, indicating that developers are successfully adjusting to current market realities. Purpose-built rental starts reached their highest levels since 2021, with almost 25,000 units under construction GTHA-wide a 32% year-over-year increase, and the largest amount underway in 50 years. Over 50 new projects (18,570 units) submitted development applications this year.

The GTA & GGH residential land market in Q3 2025 experienced adjustment and stabilization, marked by new, lower price levels and cautious optimism. Despite lower transaction volumes year-over-year, the fundamentals suggest a market regaining its balance, with buyers and developers both acting with discipline in an environment shaped by affordability constraints and macroeconomic uncertainty. The outlook calls for continued resilience, but future new housing supply challenges remain a critical consideration.

For further reading: