Q3 2025 Retail Market Report

Market Overview

Retail in the GTA held steady in Q3 2025, with strong demand in suburban areas, especially in grocery-anchored and service-based plazas. Vacancy rates edged down slightly, showing that well-located assets continue to attract tenants despite broader economic pressure. The Greater Toronto Area (GTA) retail real estate market demonstrated significant stability and resilience in the third quarter of 2025.

GTA Retail Sales

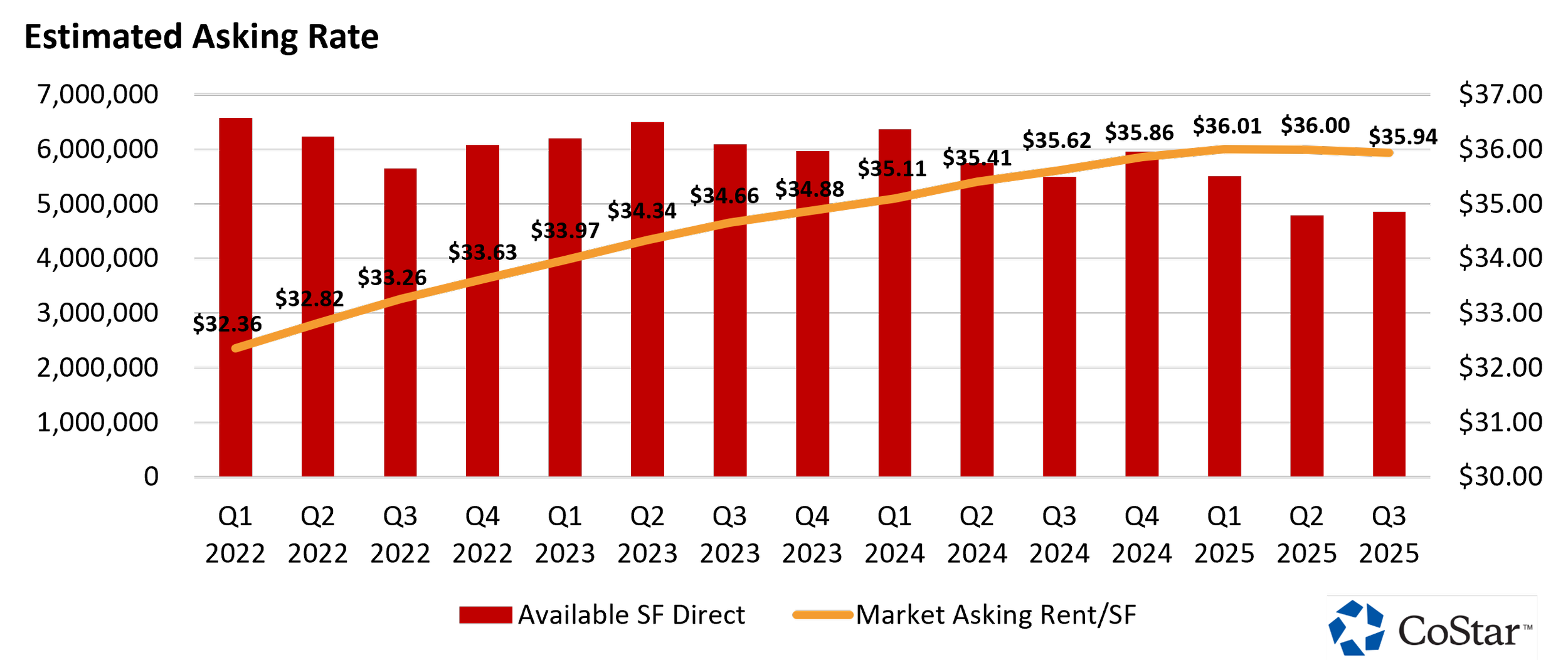

Driven by strong absorption in the suburbs, the overall vacancy rate edged down slightly in Q3. This consistent demand, combined with a limited new supply, allowed for modest increases in lease rates. Retailers focused on essential services and daily needs continue to lead leasing activity.

Lease rates saw modest increases, driven by limited new supply and consistent demand. Urban landlords held firm on pricing, while secondary markets used competitive rates to draw interest.

GTA Retail Market Data

The GTA retail market remained stable in Q3 2025, with cap rates holding steady across most asset classes. Malls continue to command the lowest cap rates (around 4.0–4.5%), indicating strong investor confidence, while General Retail and Strip Centers sit in the mid-5% range. This stability suggests a balanced market where risk and return are well-aligned - good news for both buyers and sellers looking to make strategic moves.

GTA Demographics

In the third quarter of 2025, Toronto continued to demonstrate a shift in population growth. As national demographic momentum slows, population growth in the GTA has done the same in Q3.

Job growth in Toronto has decelerated somewhat, but remains buoyed in comparison to the national trend. The alignment of population and employment growth highlights the city's economic resilience and supports long-term stability in the real estate sector. These indicators are key to understanding market fundamentals and anticipating housing demand across the Greater Toronto Area.

Market Outlook

The GTA's alignment with these new consumer demands has kept its real estate fundamentals strong. Investor confidence in this necessity-based retail model held firm. Investment volumes remained stable, tracking the five-year average. This sustained confidence is evidenced by a slight compression in cap rates and firm pricing per square foot. New development remains cautious, with a clear focus on integrating retail into mixed-use projects that support urban residential growth.

For further reading: